Doji Candlestick Chart Pattern Forex Trading

Key takeaways Frequently Asked Questions What is the Long-Legged Doji Pattern? The long-legged Doji is a Japanese candlestick pattern that signals market indecision. It consists of a single candle with long wicks and exact or approximate opening and closing prices. In partnership with Friends cashed in on GameStop, while you were playing games?

What Is Doji Candlestick? How To Use Doji Candlestick Patterns

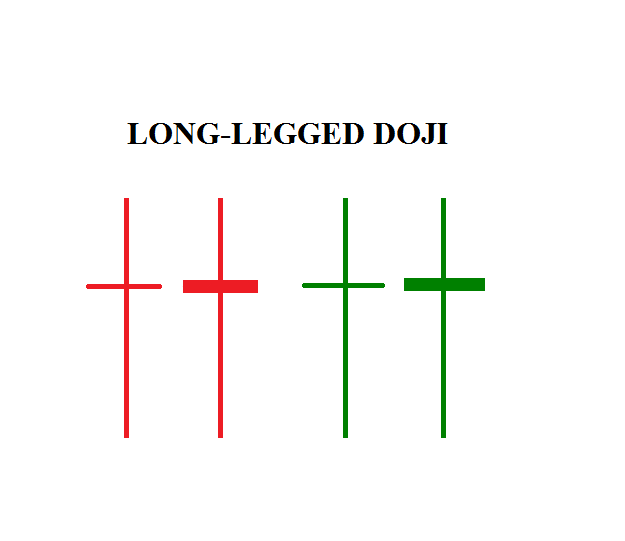

The Long Legged Doji is a neutral candlestick formation that indicates market indecision. The long-legged Doji is distinguished by a long upper and lower shadow, as well as a small real body in the centre. Long shadows indicate significant price movement during the period, with buyers and sellers pushing the price up and down.

Long Legged Doji Candlestick Pattern [PDF Guide] Trading PDF

Definition Long-legged Doji candlestick is a type of Doji candlestick that has a long lower and upper wick. All the Doji candlesticks have the same opening and closing price. The high and low make a difference between types of Doji. Long-legged Doji represents indecision in the market.

The Complete Guide to Doji Candlestick Pattern

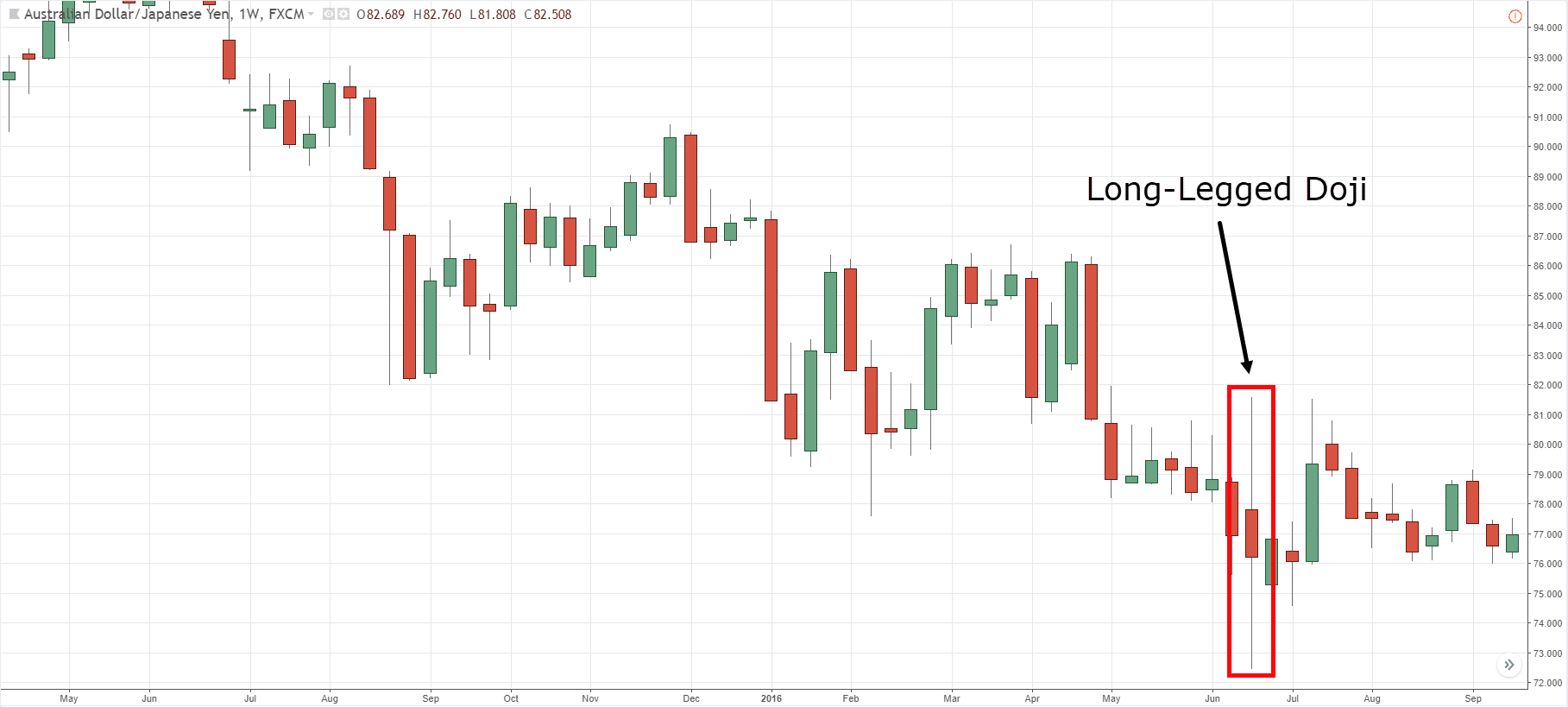

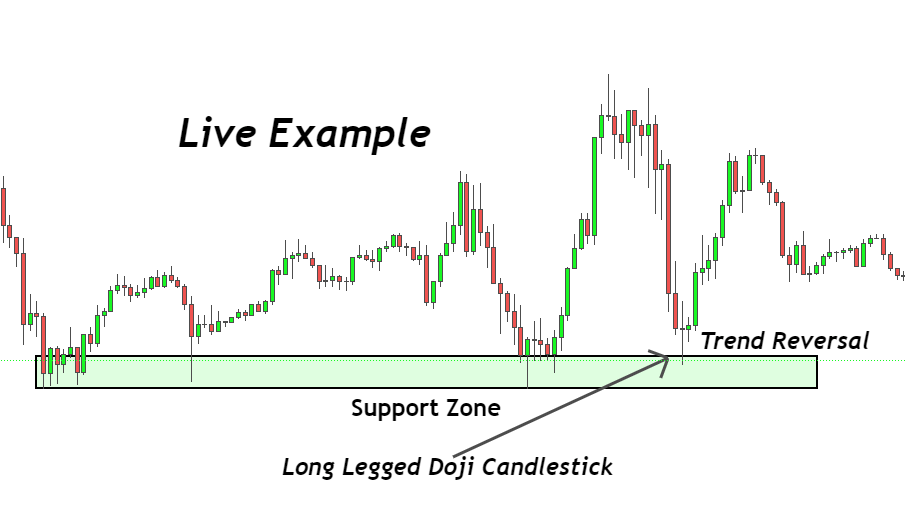

The long-legged doji is a candlestick pattern that tells us that the market has reached a point where there is an equilibrium between buying and selling pressure. As such, occurring after a trend, it's an indication that the market no longer possesses the power needed to continue in the same direction. Long-Legged Doji Examples

Long legged Doji Candlestick A Trader's Guide ForexBee

Long-legged doji candlesticks are a member of the doji family. They are indecision candlesticks with a small real body, a long lower shadow, and a smaller upper wick. They can be found in up-and-down trends and are bullish or bearish coloring on stock charts. Long-legged doji candlesticks tell the story of indecision.

Long Legged Doji Candlestick Pattern Best Analysis

Long legged Doji candlestick - key takeaways. The long-legged doji is a candlestick made up of long upper and lower shadows and has the same open and close price. The pattern shows indifference and is most noticeable after a strong progression or decline. While some traders may act on the no-candlestick pattern, others want to see what price.

LongLegged Doji Candlestick Definition and Trading Example

The long-legged doji is a candlestick that consists of long upper and lower shadows and has approximately the same opening and closing price. The pattern shows indecision and is most.

Long Legged Doji Candlestick Pattern Best Analysis

A doji (dо̄ji) is a name for a trading session in which a security has open and close levels that are virtually equal, as represented by a candle shape on a chart. Based on this shape, technical.

:max_bytes(150000):strip_icc()/dotdash_final_Long_Legged_Doji_Dec_2020-01-3a0736ccab274be08f5910be2ee88028.jpg)

The LongLegged Doji Trading the Right Candlestick Pattern

The long-legged doji candlestick pattern is a single-candle pattern that is characterized by little or no real body and long upper and lower shadows. This pattern occurs in a market with high volatility and price fluctuations. It indicates market indecision in a spiky volatile market.

How To Trade the LongLegged Doji Candlestick

The Doji candle is the point on a candlestick chart where the opening and closing security prices become equal, temporarily keeping the market in equilibrium. The candlestick chart can form different Doji patterns depending on the price trends. The four main types of Doji patterns commonly seen are - common, gravestone, long-legged, and.

:max_bytes(150000):strip_icc()/dotdash_Final_Dragonfly_Doji_Candlestick_Definition_and_Tactics_Nov_2020-01-eb0156a30e9745b687c8a65e93f54b07.jpg)

The LongLegged Doji Trading the Right Candlestick Pattern

The long-legged doji is a type of doji candlestick pattern with an extensive range. The long-legged doji candle gets its name based on how it appears on a candlestick chart-a doji with long legs. The long-legged adjective doesn't provide insight into how to run with this pattern.

Using Long Legged Doji in Trading. How Are They Different? DTTW™

The Long-Legged Doji is a significant candlestick chart pattern in trading, indicating market indecision and potential trend reversals. Traders can identify and interpret this pattern using various techniques and combine it with other tools such as Bollinger Bands, volatility filters, and oversold/overbought conditions.

What are the many forms of Doji Candlesticks and how can I trade them

Long-Legged Doji Home Candlestick Patterns Basic Candles Long-Legged Doji See our Patterns Dictionary for other patterns. Check our CandleScanner software and start trading candlestick patterns! Figure 1. Long-Legged Doji (basic candle). Japanese name: juji, yose Forecast: lack of determination Trend prior to the pattern: n/a

Mastering Long Legged Doji Candlestick Patterns Tips for Day Traders

What is the long-legged doji candle? A long-legged doji candlestick pattern looks like a cross. Here's how it can be broken down: 1. The body is very tiny or doesn't exist. 2. The close and open prices are in the candle's mid-range What does it say about the market?

LongLegged Doji

The Long-Legged Doji is a 1-bar candlestick pattern. It has a small body and long upper and lower shadows. It reflects indecision in the market. What you'll discover in this article ++ show ++ 1 How to identify the Long-Legged Doji candlestick pattern? 2 What does this pattern tell traders?

Bearish Long Legged Doji Candlestick Forex Trading

What is a Long-Legged Doji Candlestick? Long-legged doji candlesticks are one of four types of dojis -- common, long-legged, dragonfly and gravestone. All dojis are marked by the fact that prices opened and closed at the same level.